Ever looked at your bank account and go, “Where’d my money vanish to?” I’ve been there, sweating over bills and praying my car doesn’t conk out. Building wealth sounds like it’s for tech nerds or rich kids, but you don’t need a loaded wallet to get going. This wealth building guide is full of easy ideas to pull you out of that paycheck-to-paycheck rut. Whether you’re scraping by or ready to save more, these tips can work. Let’s jump in and fix your money mess.

Why Saving Feels Impossible

Okay, real talk: keeping cash in your pocket is hard. The top 10% in the U.S. grab 70% of all the wealth, leaving the rest of us with like 2%. Rent’s wild, groceries are nuts, and doctor bills? Forget it. Saving $100 a month feels like climbing Everest in flip-flops.

It’s not just numbers. Your fridge dies, or your kid’s field trip costs $50, and your savings are toast. I saw some statistics stating that middle-class individuals barely saw their wealth increase from 2001 to 2016, while the wealthy continued to accumulate wealth. It’s like the world’s built to keep you stuck, and that’s a total drag.

The Broke Struggle Is Real

Picture this: you’re working your butt off, maybe hustling a side job, but your bank account’s still sad. Rent’s due, your dog needs shots, and that credit card bill’s giving you side-eye. You want to save, but life’s like, “Ha, here’s a parking ticket.” It’s not just about cash—it’s the stress of feeling like you’re drowning. With $83 trillion in wealth set to flow to the super-rich over the next 20 years, it’s like you’re stuck in quicksand. It makes you wanna give up.

But hold up—you can fight back. You don’t need a fancy degree or a rich uncle. This wealth building guide has down-to-earth ideas to get you moving.

Your Wealth Building Guide: 5 Simple Steps

I’ve seen people—my coworker, my sister—go from broke to saving real money with these steps. A study I read said 75% of millionaires got there by saving and investing bit by bit. You can too.

1. Get Your Head in the Game

First things first: wealth starts in your noggin. If you think money’s just for “lucky” folks, you’re screwed. Change how you think, and you’ll spot ways to make it happen.

- Got a dream? A new couch, a chill retirement? Jot it down to keep you pumped.

- Learn stuff. I nabbed “The Millionaire Next Door” from a thrift store, and it changed how I see cash. Money blogs are dope too.

- Quit saying “I’m broke.” Try, “How can I pull this off?”

My coworker was always griping about never being able to afford a car. Once he started believing he could, he skipped his daily Dunkin’ run and saved enough for a used Toyota in a year.

2. Get a Grip on Your Spending

A budget’s like telling your money, “You’re not the boss of me.” Figure out what you earn, subtract what you spend, and save what’s left.

Here’s an idea: 50% of your cash for stuff you need (rent, groceries), 30% for fun (like Netflix or wings), and 20% for savings or debt. Mess with it to match your life.

- I’m hooked on Mint—it’s like a money babysitter that tracks your spending.

- Ditch small splurges. That $4 coffee every day? That’s $1,000 a year you could pocket.

- Check your spending every month. Little tweaks make a big difference.

A budget’s about picking what you love. Buying a home added almost $100,000 in wealth for low-income people over the last decade as houses got pricier. That starts with saving. Scope out NerdWallet’s budgeting tips for more.

3. Dump Your Debt

Debt’s like a bad roommate—it keeps taking your stuff. Credit cards with crazy interest rates are the worst. Pay them off fast to keep your cash.

- Start with the smallest debt. Knocking it out feels like a party.

- Or hit the one with the highest interest to save more long-term.

- Don’t add new debt. Save up for stuff like a new laptop.

Once debt’s gone, toss that money into savings. It’s like finding $20 in your jeans. Got a blog? Link to something like “Tricks to Ditch Debt.”

4. Make Your Money Grow

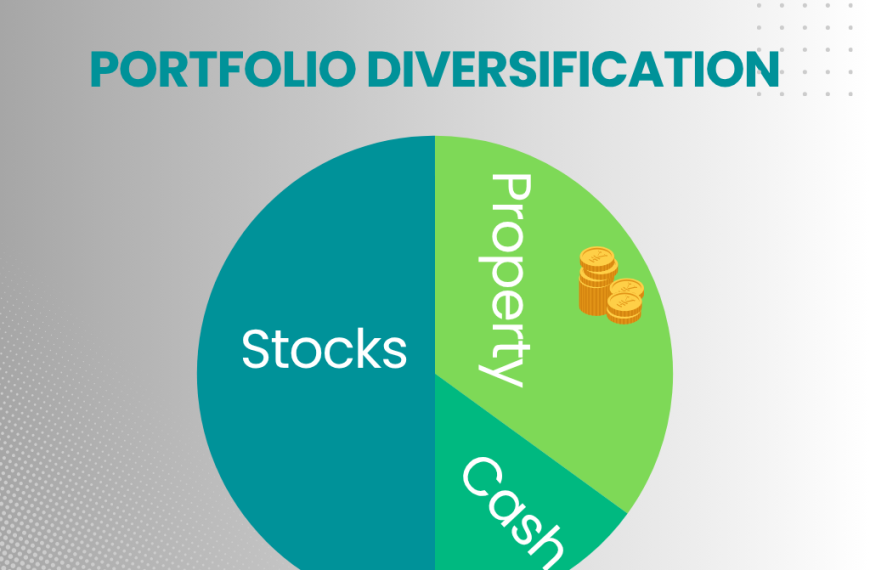

Saving’s fine, but investing makes your cash grow like weeds. You don’t need to be a stock market guru—start small.

- Your job’s 401(k) match? Grab it—it’s free money. Or try a Roth IRA to skip taxes later.

- Index funds, like S&P 500 ones, are easy and grow about 10% a year over time.

- A house can build wealth, too. My sister’s place is worth way more than she paid.

Your savings can balloon over time. Put away $100 a month at 7% interest, and in 35 years, you’ve got $150,000. Half of Americans build wealth through stocks. Check Vanguard’s investing tips for the lowdown.

5. Hustle for Extra Cash

One job might not cut it. A side gig can make your savings pop.

- Try something fun, like selling old jackets on eBay or driving for Lyft.

- Set up an easy win, like a budget spreadsheet you sell online—my buddy swears by this.

- Learn a skill. My sister took a free design course and now makes extra cash on logos.

Millionaires often have a few ways to earn money. Even a part-time gig helps 44% of people build wealth. If you’ve got a blog, link to “Top Side Hustles for 2025.”

From Broke to Okay: Sarah’s Story

So, there’s this teacher, Sarah, whose story I found online. In her 20s, she was buried in $30,000 of credit card debt from buying too many candles and takeout. She got fed up, made a budget, and quit her DoorDash habit. She tackled her smallest debts first, which kept her going, even though she still splurged on a $150 spa day once. By 30, she was debt-free and putting 15% of her paycheck into a Roth IRA and stock funds. She also tutored kids online for an extra $400 a month—enough to feed her candle obsession and still save. Now at 35, Sarah’s got $200,000 and hopes to retire by 55, though she admits she’s no money wizard. A Ramsey study says most millionaires are like her—starting from scratch, not a trust fund.

Don’t Mess It Up

You’ve got a plan, but it’s easy to slip. Watch out:

- Got a raise? Don’t buy a big TV—save it.

- Don’t throw all your cash into one stock or some crypto hype.

- Those “get rich quick” ads? Total scams. Stick to what’s real.

Check FTC’s scam tips to stay safe.

Protect Your Cash

As your money grows, keep it safe. Life’s full of surprises.

- Stash 3–6 months of expenses for when your car breaks down.

- Get health and life insurance to avoid big hits.

- Make a will so your cash goes where you want.

Let’s Get Moving

This wealth building guide is your way out of broke town. Cash is tighter than my jeans after Thanksgiving, but you can get ahead with a better mindset, a budget you use, no debt, smart investing, and some extra hustle. Try this: track your spending for a week, skip one takeout order, and read an investing blog. Little stuff adds up to big money.

Got a blog? Link to posts like “Investing for Newbies” or “Budget Hacks That Work.” What’s your next move? Drop it in the comments, and let’s get your cash growing!

By

By

By

By

By

By